The rounding top, also called an inverse saucer, is a powerful bearish reversal pattern that signals a gradual, sustained shift in market sentiment from bullish to bearish. Unlike sharp spike reversals, the rounding top forms slowly over weeks or months as buying momentum progressively exhausts. This guide covers everything traders need to know: structure, psychology, entry techniques, risk management, and confirmation signals.

What is a rounding top?

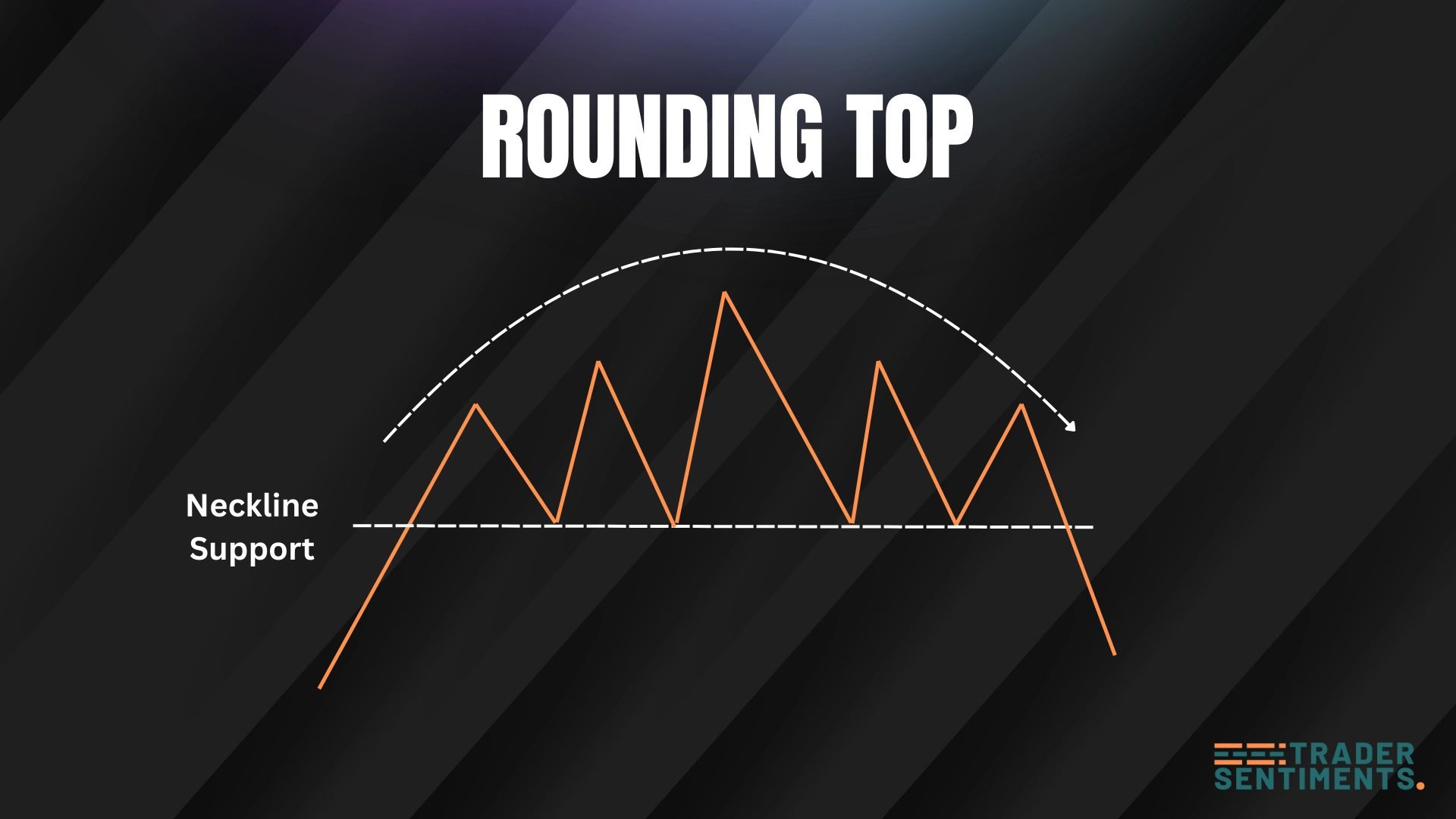

The rounding top describes a gradual price shift from bullish to bearish. It looks like an inverted bowl or dome, signifying that buyers are gradually leaving the market and sellers are taking control.

Pattern structure

- Uptrend: Prior move up.

- Peak: Gradual rounding off of highs.

- Downtrend: Price accelerates downward.

- Neckline: The support level at the base of the curve.

How to identify

Visual curve on the chart.

Volume often mirrors the price shape (high at edges, low at peak) or just declines.

Trading the pattern

Entry rules

- Breakout: Sell when price breaks below the neckline support.

Stop-loss placement

Above the peak of the curve (often too wide).

Above the most recent swing high before the breakout.

Profit targets

Project the height of the dome downward from the breakout.

Common mistakes

Entering before the pattern completes (it takes a long time).