Smarter trading decisions

powered by real-time sentiment

Confirm bias using trader positioning, news impact, and market psychology. Built for clean signals — not noise.

Trader Sentiment Snapshot

Market Mood

Not financial advice • Use as confirmation with your setup

Real-time market bias • Liquidity insights • News sentiment

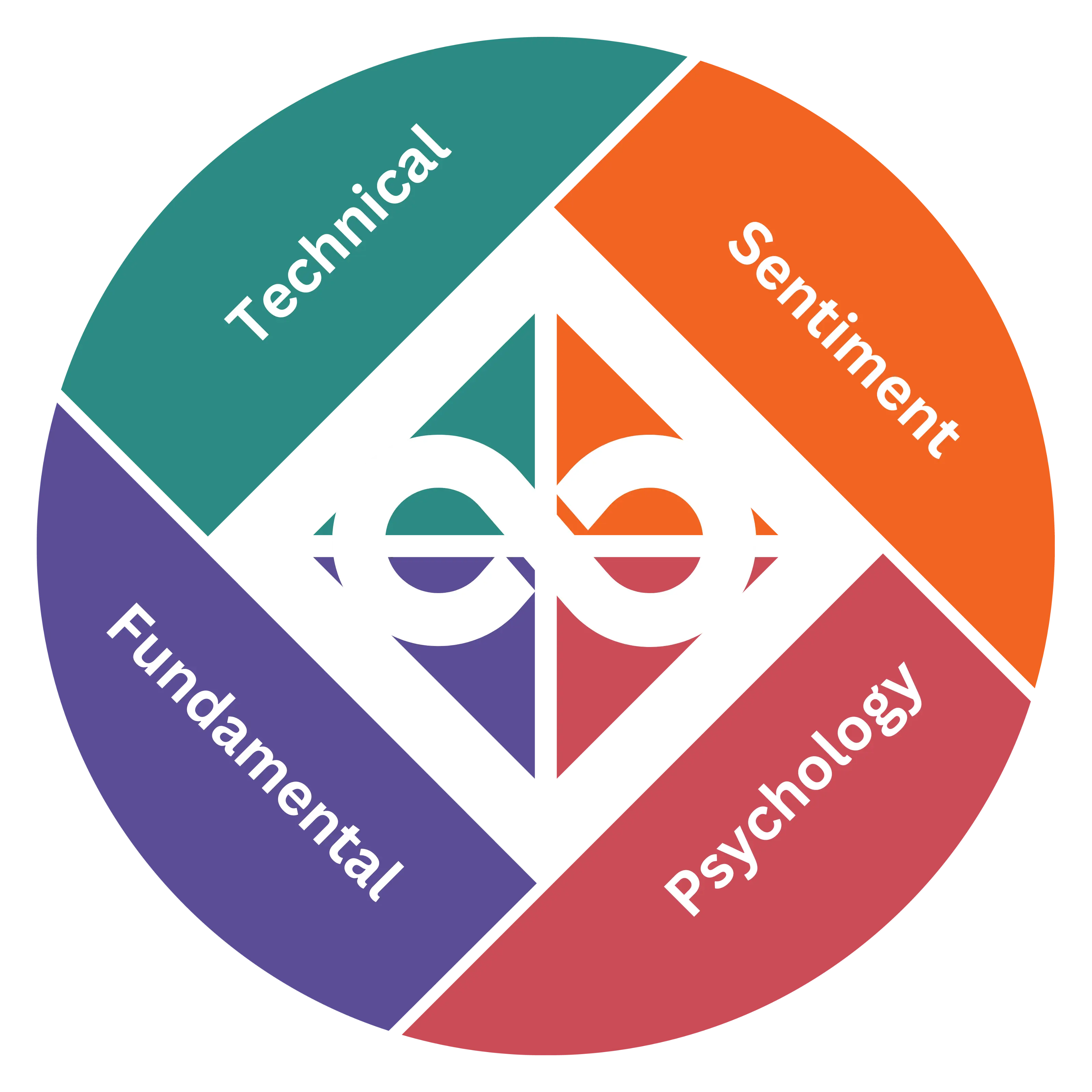

Why Use Trader Sentiments?

Stop trading blind. TraderSentiments helps you read the crowd in real time — identify bullish vs bearish bias, spot extremes, map liquidity traps, and align entries with the strongest market narrative.

Live

Real-time Bias

Map

Stop Loss Clusters

AI

News Sentiment

What You Get With TraderSentiments

Built for traders who want clarity — from market direction to entry confidence and risk control.

Market Bias

See whether traders are bullish or bearish instantly.

Contrarian Signals

Spot reversal risk when sentiment becomes extreme.

Sentiment Metrics

Based on real trader positioning data.

Price Alignment

Compare sentiment with trend and volatility.

Risk Awareness

Identify crowded trades before reversals.

Strategy Support

Use sentiment as confirmation, not guesswork.

How It Works in 3 Steps

Use sentiment as a decision layer — confirm trend strength, avoid crowded traps, watch for reversals at extremes, and align with news impact.

Read Bias

Check bullish vs bearish positioning and understand the market mood in seconds.

Map Liquidity

Use stop-loss clusters to anticipate sweeps, traps, and key reaction zones.

Filter With News

Confirm timing with news sentiment — avoid high-risk moments and align with macro tone.

Example Insight

“When everyone is long… risk of reversal increases.”

Extreme sentiment is a warning sign. Combine it with structure (S/R, liquidity, trend) to time entries and exits better.

Bullish

68%

Bearish

32%

Tip: Use sentiment extremes as a “warning layer”, then confirm with price action before entry.

What is Sentiment Data?

Sentiment data reflects the collective mood and positioning of traders and investors. It shows whether the crowd is leaning bullish or bearish on future price movements.

Spot trend confirmation

Identify crowded trades

Find extreme reversal zones

Improve timing & exits

Why is Sentiment Data Important?

Sentiment data helps confirm market trends, signals potential reversals at extreme levels, and provides insights into crowd psychology — enabling traders to anticipate traps and make more informed decisions.

Trend Confirmation

If sentiment aligns with structure, confidence increases.

Reversal Alerts

Extreme positioning can signal exhaustion and turning points.

Crowd Psychology

See whether traders are chasing or getting trapped.

What is Stop Loss Cluster?

Stop Loss Cluster is a liquidity insight that highlights zones where many traders are likely placing stop-loss orders. These areas often become targets for price “stop hunts” before the market moves in the real direction.

Shows likely liquidity pools

Helps spot stop-hunt zones

Improves entry timing

Supports smarter SL placement

Quick Example

“Liquidity sits where most stops are placed.”

When price approaches a cluster, volatility often spikes. A sweep below/above the cluster can trigger stops — then price may reverse.

Tip: Wait for the sweep + confirmation candle (rejection/engulfing/structure shift) before entry.

Why it matters

Avoid traps & trade with better risk

Stop loss clusters help you avoid chasing breakouts into liquidity. Instead, you can plan entries around where the market is likely to grab liquidity first.

Avoid False Breakouts

Clusters often sit near obvious highs/lows.

Smarter SL Placement

Stops placed beyond clusters are less likely to be hunted.

Better TP Zones

After a sweep, price often moves away strongly.

What is News Sentiment?

News Sentiment is an AI-driven interpretation of market headlines and narratives. It helps you quickly understand whether news is likely to be bullish, bearish, or neutral — and which asset or currency may be impacted.

Bullish / bearish / neutral classification

Faster headline filtering

Event-driven risk awareness

Better session planning

Quick Example

“The tone matters more than the headline.”

Two headlines can look similar — but the market reacts based on expectations and tone. News sentiment helps you interpret the narrative faster.

Tip: Combine news sentiment with technical levels to avoid entering right before volatility spikes.

Why it matters

Trade with context, not noise

News sentiment helps you avoid overreacting to headlines and supports better planning around high-impact events — especially during sessions like London/NY open.

Filter Noise

Focus on high-impact narratives instead of endless headlines.

Avoid Bad Timing

Reduce risk of entering before sudden volatility.

Align With Macro

Support trades with broader market direction.

Built for Every Trading Style

Whether you scalp, swing, or invest — use sentiment + clusters + news to trade with clarity.

Scalpers

Use stop-loss clusters to avoid false breakouts and time quick reversals after liquidity grabs.

Liquidity sweeps

Session timing

Fast bias check

Swing Traders

Combine sentiment bias + structure for higher conviction entries and cleaner holds.

Trend confirmation

Extreme reversals

Smarter stop placement

Investors

Use news sentiment to understand macro tone and avoid positioning against major narratives.

Macro filtering

Risk events

Market psychology

Frequently Asked Questions

Quick clarity before you start using sentiment, clusters, and news sentiment in your strategy.

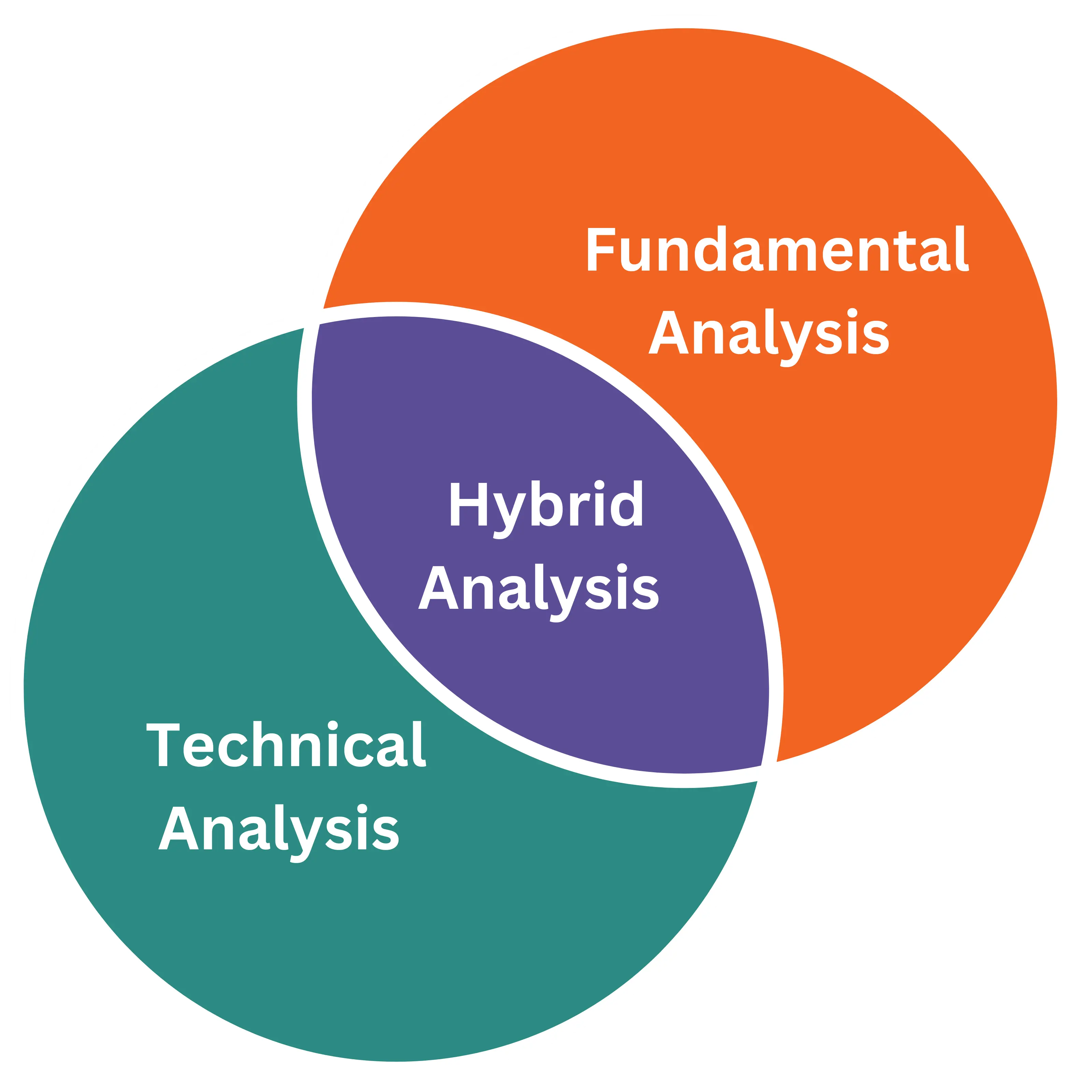

How do I use sentiment without blindly following the crowd?+

Treat sentiment as a decision layer, not a signal. First read bias, then confirm with price structure (support/resistance, trend, liquidity zones).

What does Stop Loss Cluster help me avoid?+

It helps you avoid common traps like breakout chases into liquidity. You can anticipate where stops sit and wait for sweep + confirmation instead.

Is News Sentiment only for news traders?+

No. Even technical traders benefit from knowing market tone and risk events. News sentiment helps you avoid bad timing and align with macro direction.

When is sentiment most useful?+

When it’s extreme (crowding) or when it aligns with trend. Extremes can signal potential reversals; alignment can confirm trend continuation.