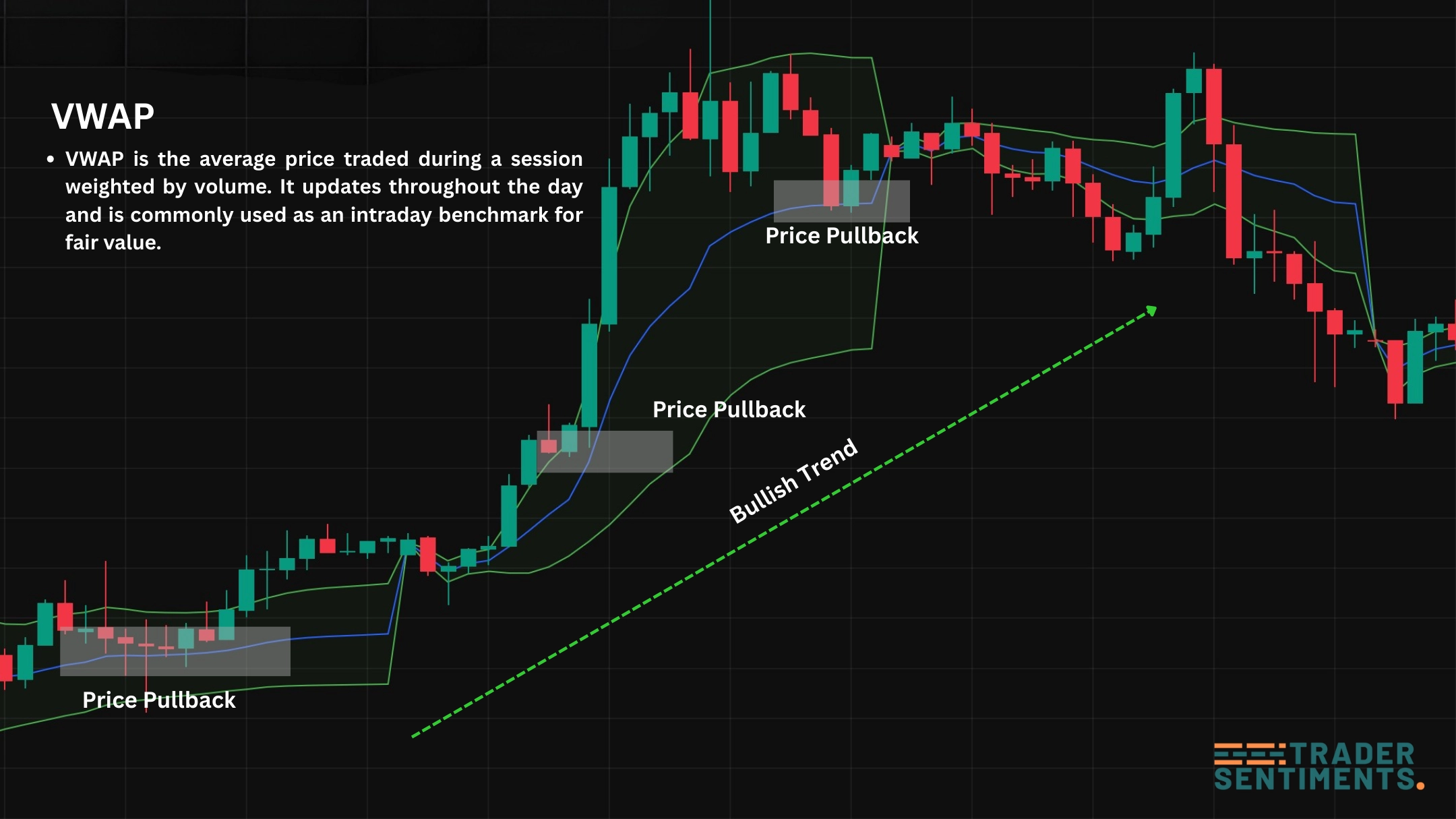

VWAP (Volume Weighted Average Price) is an intraday benchmark that shows the average traded price weighted by volume. Traders use VWAP to frame trend bias (above/below VWAP), identify mean-reversion opportunities, and mark dynamic intraday support/resistance. This guide explains how VWAP works, how to read it, and practical rules-based strategies with risk management.

VWAP explained

VWAP is often described as “fair value” for the current session because it averages price while giving more weight to prices traded with higher volume. That’s why institutions use it as a benchmark for execution quality.

- Intraday bias: above VWAP vs below VWAP

- Mean reversion: stretched moves returning to VWAP

- Support/resistance: reactions around VWAP line

- Execution benchmark (especially in stocks/futures)

How VWAP is calculated

VWAP is the cumulative value traded divided by cumulative volume during a session: it updates bar-by-bar as new volume comes in.

- High-volume prices influence VWAP more than low-volume prices

- VWAP usually resets each session/day (intraday benchmark)

- Anchored VWAP starts from a chosen point instead of session open

How to read VWAP (bias + context)

A simple VWAP framework many traders use:

Bullish intraday bias. Prefer longs on pullbacks; avoid fading band-walk momentum.

Bearish intraday bias. Prefer shorts on pullbacks; avoid catching falling knives without structure.

Often range conditions. Be cautious: VWAP can be a “magnet” and signals can whipsaw.

VWAP as intraday support/resistance

In many sessions, VWAP behaves like a dynamic level. Price may reject it, reclaim it, or use it as a pivot. The cleanest VWAP trades usually include structure confirmation.

- Mark VWAP and watch how price reacts on retests

- Prefer trades aligned with higher timeframe structure

- Use a trigger: rejection candle / break-and-retest / displacement

- Stops go beyond the invalidation (not “just beyond VWAP”)

Example: VWAP behaves like a dynamic intraday pivot — rejection → reclaim → retest.

VWAP mean reversion strategy (rules)

Mean reversion works best in range days. You’re basically trading “stretch → snap-back” toward VWAP. Avoid mean reversion when the market is clearly trending and walking away from VWAP.

- Market: range day / no strong trend

- Setup: price extends far from VWAP (often with a spike)

- Trigger: rejection back toward VWAP + structure confirmation

- Stop: beyond the swing extreme

- Target: VWAP first, partial profit before VWAP if needed

VWAP trend strategy (rules)

In strong trends, VWAP often acts like a pullback level. Traders use it to enter with trend bias instead of fading momentum.

- Market: clear intraday trend (higher highs/lows or lower highs/lows)

- Bias: price holds above VWAP (bull) or below VWAP (bear)

- Entry: pullback to VWAP + rejection / reclaim confirmation

- Stop: beyond pullback swing (structure invalidation)

- Target: session highs/lows, next key level, or scaled exits

Anchored VWAP (AVWAP) concept

Anchored VWAP starts from a chosen “event point” instead of the session open. Common anchors: a major swing low/high, breakout candle, or news event. It’s used to track fair value after a regime shift.

- Anchor at a key high/low after a strong reversal

- Watch AVWAP retests as “fair value” pullbacks

- Combine with structure and liquidity zones

Risk management and common mistakes

- Fading trends just because price is “far from VWAP”

- Trading VWAP without market context (trend vs range)

- Stops placed too tight around VWAP (noise stop-outs)

- Ignoring volatility/news spikes

- Session timing (avoid dead hours)

- Structure confirmation (BOS / range break)

- Volatility awareness (ATR or session range)

- One clean setup is better than many touches

- Risk a fixed % per trade (example: 0.5%–1%)

- Stops go where the setup is invalidated (structure)

- Scale out logically (VWAP / key levels), not emotionally

- Track spread + slippage in fast conditions