The rounding bottom, also called a saucer bottom, is a powerful bullish reversal pattern that signals a gradual, sustained shift in market sentiment from bearish to bullish. Unlike sharp V-shaped reversals, the rounding bottom forms slowly over weeks or months, making it one of the most reliable long-term reversal signals in technical analysis. This guide covers everything traders need to know: structure, identification, entry rules, risk management, and the psychology behind the pattern.

What is a rounding bottom?

The rounding bottom, also known as a saucer bottom, is a long-term bullish reversal pattern that signals an exhaustion of selling pressure and a gradual shift toward buying interest. Unlike sharp reversals like a V-bottom or double bottom, the rounding bottom forms very slowly, often developing over weeks to several months, making it one of the most reliable reversal signals in technical analysis.

The pattern gets its name from the visual appearance of its price curve, which resembles the bottom of a saucer or bowl. It is most commonly found on daily and weekly charts in stocks and commodities, often appearing after extended downtrends or prolonged consolidation phases. When confirmed with a volume breakout, the rounding bottom can precede powerful, sustained uptrends that last for months.

Pattern structure

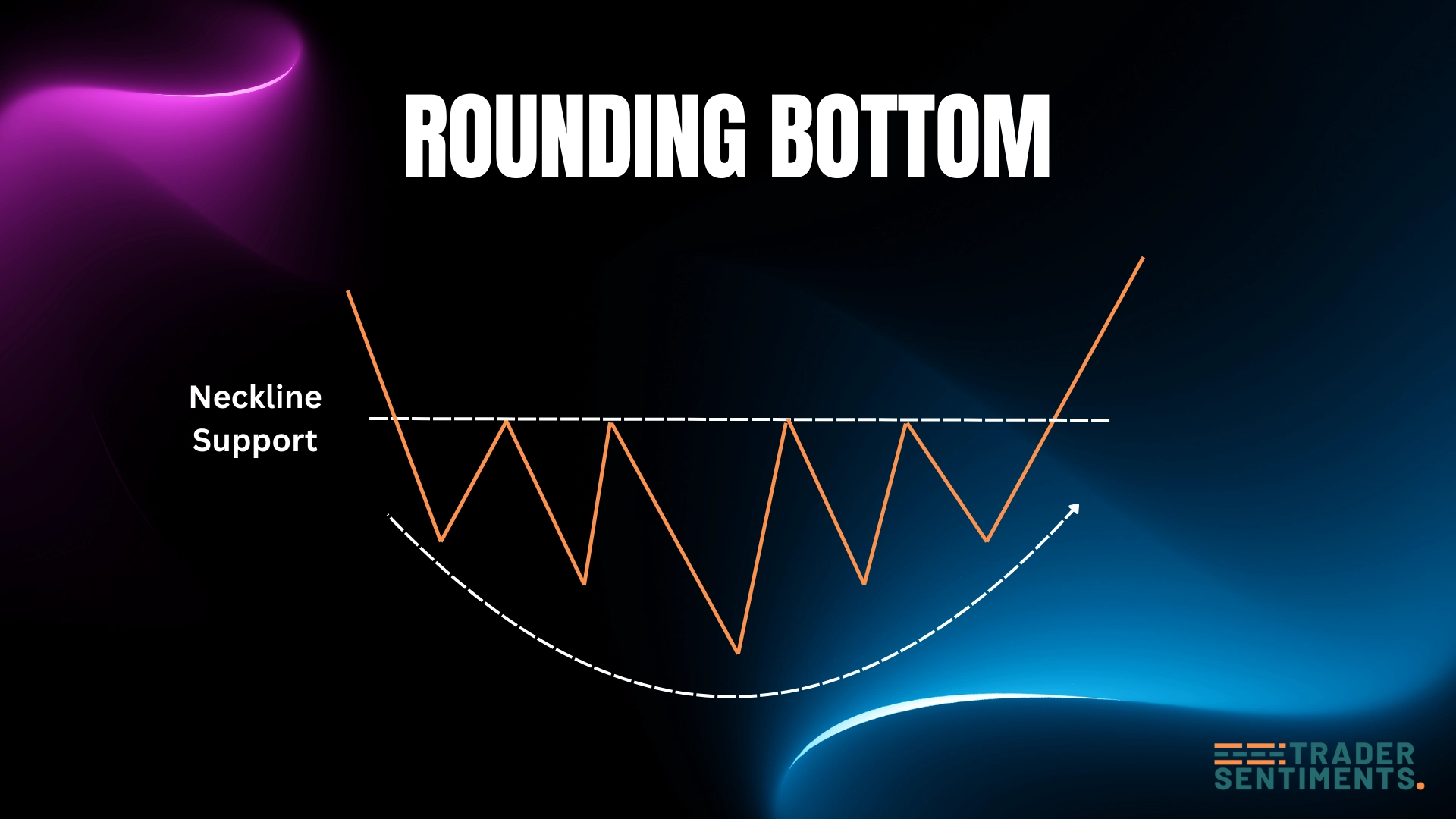

A complete rounding bottom consists of four distinct phases. Understanding each phase helps traders recognize the pattern early and plan their entry with precision.

- Prior downtrend: The pattern begins after a sustained decline. The downtrend establishes the context for the reversal, the longer and steeper the downtrend, the more significant the reversal signal.

- Rounding base (the saucer): Price forms a gradual, curved bottom. There are no sharp spikes or V-shaped bounces. The slope of the curve decelerates as selling pressure exhausts, and buying interest slowly builds. Volume typically declines during this phase.

- Right-side recovery: Price begins climbing the right side of the saucer. The slope mirrors the left side relatively symmetrically. Volume starts to increase as buyers gain confidence.

- Neckline breakout: Price breaks above the resistance level established at the start of the pattern (the neckline). This breakout, ideally accompanied by a surge in volume, confirms the pattern and signals the entry point.

How to identify

Identifying a rounding bottom correctly requires looking for several key characteristics simultaneously. Missing any one of these can lead to misidentification, particularly confusing it with a V-bottom or an irregular consolidation.

The bottom of the pattern must be gradual and rounded, not sharp or pointed. If the base has multiple sharp spikes, it may be a different pattern. The smoother the curve, the more textbook the formation.

A valid rounding bottom takes significant time to form, typically at least several weeks on the daily chart, and often 3,12 months on the weekly chart. Patterns that form in just a few days are likely short-term bounces, not true rounding bottoms.

Volume should follow the shape of the saucer. It typically declines as price approaches the bottom, then gradually increases as price recovers on the right side. A major volume spike on the necklinebreakout is the most important confirmation signal.

There should be a clear horizontal resistance level at the top of the pattern, the level where price was before the decline began. This neckline is the key level to watch for the breakout.

Psychology behind the pattern

The rounding bottom is a visual representation of a shift in the balance of power between buyers and sellers. Understanding the psychology behind it helps traders trust the signal and hold through the full move.

During the left side of the saucer, sellers are in control. Negative news, poor earnings, or macro headwinds push price steadily lower. However, as price reaches the bottom of the curve, selling pressure gradually exhausts, the weakest sellers have already exited, and few new sellers remain willing to push price lower.

At the base of the saucer, the market enters a period of equilibrium. Smart money, institutional investors and long-term buyers, begins accumulating positions quietly, which explains why volume is low during this phase. They accumulate without alerting other market participants.

As price starts rising on the right side, retail traders and momentum followers begin to notice and join in. When price finally breaks above the neckline, it triggers buy stops and FOMO (fear of missing out) buying, resulting in the volume surge that confirms the breakout.

Timeframes and markets

The rounding bottom is a long-term pattern and works best on higher timeframes. Here is how it performs across different chart periods and asset classes:

The most powerful and reliable rounding bottoms form on weekly and monthly charts. These often precede major bull runs lasting 1,3 years. Commodity markets like gold and oil produce excellent examples.

Daily chart rounding bottoms forming over 2,6 months are strong signals, especially in individual stocks after earnings-related sell-offs or sector rotations. The post-breakout move often lasts 3,6 months.

On intraday charts like 4H, patterns that resemble a rounding bottom often lack the sustained institutional accumulation that drives long-term trends. Use caution and require stronger volume confirmation before trading on these timeframes.

Trading the pattern

Trading the rounding bottom requires patience. The setup develops slowly, and jumping in too early, before the neckline breakout, exposes traders to continued consolidation or false starts. The ideal approach is to wait for the confirmed breakout, then enter with a clear stop-loss and defined profit target.

Entry rules

- Breakout entry: Wait for price to close above the neckline resistance on a daily candle. Don't anticipate the breakout, let price confirm it first.

- Volume confirmation: The breakout candle should show a meaningful increase in volume compared to recent average volume. Low-volume breakouts are significantly more likely to fail.

- Retest entry (optional): After the initial breakout, price sometimes pulls back to retest the neckline as support. This retest offers a second, lower-risk entry point with a tighter stop-loss.

- Avoid early entries: Do not enter while price is still forming the right side of the saucer. The pattern is not confirmed until the neckline is broken.

Stop-loss placement

Proper stop-loss placement is critical when trading the rounding bottom. The two main approaches offer different risk-reward profiles:

Place the stop-loss below the lowest point of the entire saucer. This gives the trade the most room to breathe but may require a smaller position size to keep risk manageable. Best for swing traders with a higher risk tolerance.

Place the stop-loss just below the most recent swing low before the breakout, or just below the neckline level after a confirmed retest. This tighter stop allows a larger position size but is more susceptible to being triggered by normal market noise.

Profit targets

The standard method for calculating the profit target is the measured move technique: measure the vertical distance from the neckline down to the lowest point of the saucer, then project that same distance upward from the neckline breakout point.

For example: if the neckline resistance is at $100 and the lowest point of the saucer is at $70, the depth is $30. The profit target is $100 + $30 = $130. Experienced traders often take partial profits at 50% of the target and trail their stop-loss on the remaining position to capture larger moves.

Confirmation signals

The rounding bottom breakout is more reliable when multiple confirmation signals align. Here are the key indicators to watch:

The most important signal. The breakout candle should have volume at least 1.5,2x the 20-day average. This confirms strong institutional participation in the move.

RSI rising above 50 and crossing upward on the weekly chart confirms the momentum shift from bearish to bullish. RSI divergence (higher lows on RSI while price makes equal lows) during the base phase is an early warning signal.

A bullish MACD crossover on the daily chart, with the MACD line crossing above the signal line while both are below zero,often precedes the neckline breakout and can alert traders early.

The 50-day MA crossing above the 200-day MA (a golden cross) during the right side of the saucer is a strong confirmation that long-term trend momentum has shifted bullish.

Common mistakes

A V-bottom has a sharp, spike-like reversal with no gradual curve. Rounding bottoms are defined by their slow, smooth formation. If the reversal happened quickly, it is not a rounding bottom.

Anticipating the breakout while price is still climbing the right side of the saucer is a common mistake. The pattern can stall and re-consolidate for weeks before the real breakout occurs. Patience is essential.

A neckline breakout on low or declining volume is a red flag. Without volume to sustain the move, breakouts frequently reverse back below the neckline, turning into bull traps.

The rounding bottom is a macro pattern. On 15M or 1H charts, what looks like a saucer is usually just random noise. Stick to daily and weekly charts for valid signals.

What invalidates the pattern

Not all rounding bottoms result in a successful breakout. Exit or avoid the trade if any of the following occur:

- Price closes back below the neckline after the breakout on high volume, this signals a failed breakout (bull trap).

- Price breaks below the lowest point of the saucer, the entire base structure collapses, invalidating the pattern and suggesting the downtrend may resume.

- Formation becomes irregular with multiple sharp spikes or V-shaped lows within the base, the pattern loses its saucer characteristic and becomes unreliable.

- Macro environment turns sharply bearish, major market crashes or sector-specific bad news during the base phase can abort the pattern regardless of its technical structure.