The rising wedge is a bearish reversal pattern, and sometimes a continuation signal during established downtrends, formed by two upward-sloping, converging trendlines. Despite the upward price action within the pattern, the narrowing range and often declining volume signal weakening bullish momentum and an impending reversal. This guide covers the pattern structure, the psychology behind it, entry techniques, and risk management for trading the rising wedge.

What is a rising wedge?

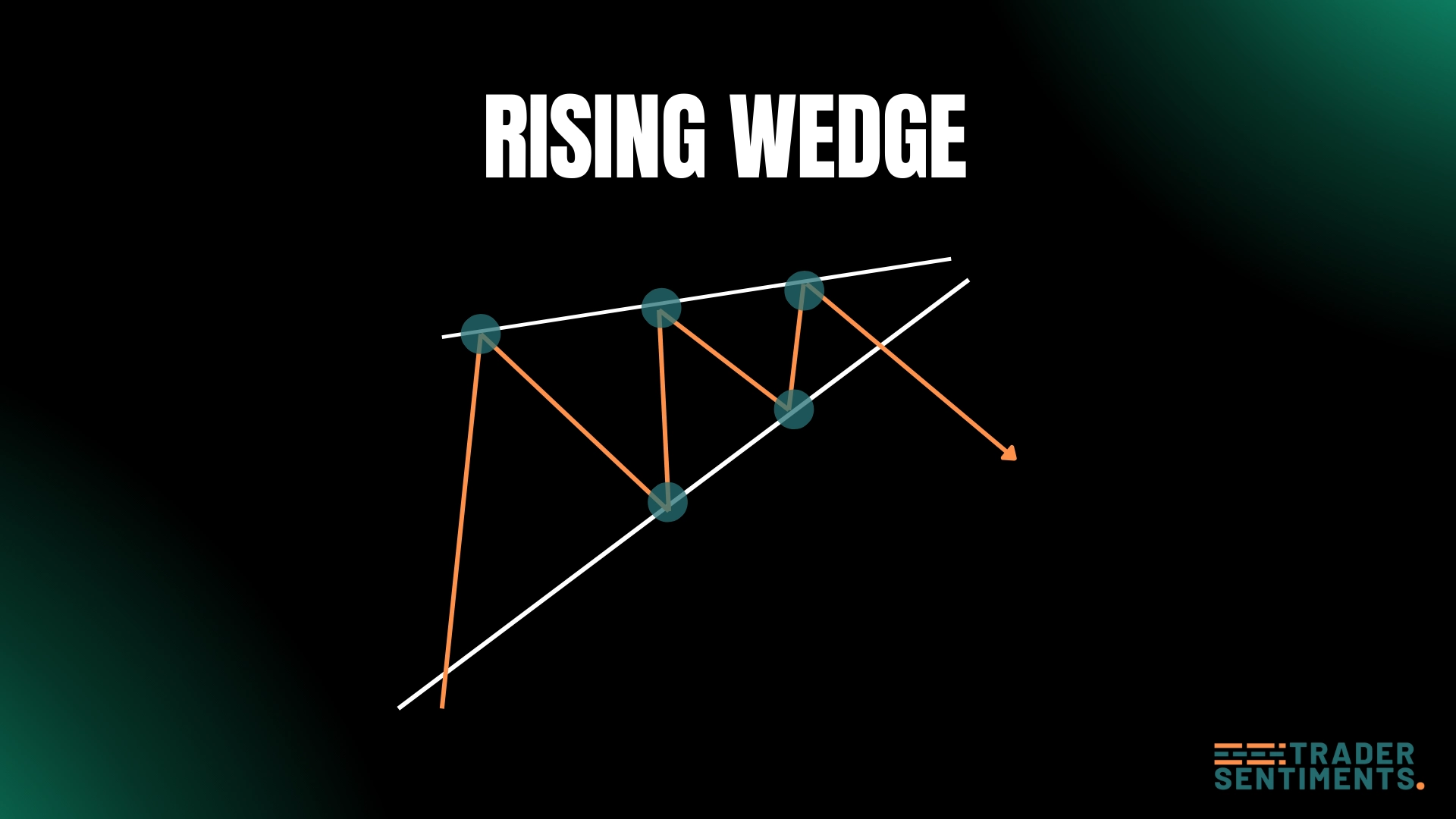

The rising wedge is a bearish pattern where price makes higher highs and higher lows, but within contracting, upward-sloping trendlines. This contraction indicates that buyers are struggling to push price significantly higher.

Pattern structure

- Converging lines: Both lines slope up, but support is steeper.

- Contraction: Range narrows as price advances.

- Volume: Typically declines.

- Breakdown: Price breaks below the support line.

How to identify

Usually forms at the end of an uptrend.

Price is still rising, but momentum slows.

Trading the pattern

Entry rules

- Breakdown: Sell when price closes below the lower trendline.

Stop-loss placement

Above the highest high in the wedge.

Above the most recent swing high.

Profit targets

Often targets the start of the wedge formation.

Common mistakes

Flags are parallel; wedges converge.