The head and shoulders is widely regarded as one of the most reliable bearish reversal patterns in technical analysis. It forms after an uptrend and consists of three peaks: a left shoulder, a taller central peak called the head, and a right shoulder at approximately the same height as the left. The pattern signals a progressive transfer of control from buyers to sellers. When price breaks below the neckline, it often marks the beginning of a significant and extended decline. This guide covers the complete structure, psychology, entry techniques, and risk management for trading the head and shoulders pattern.

What is a head and shoulders pattern?

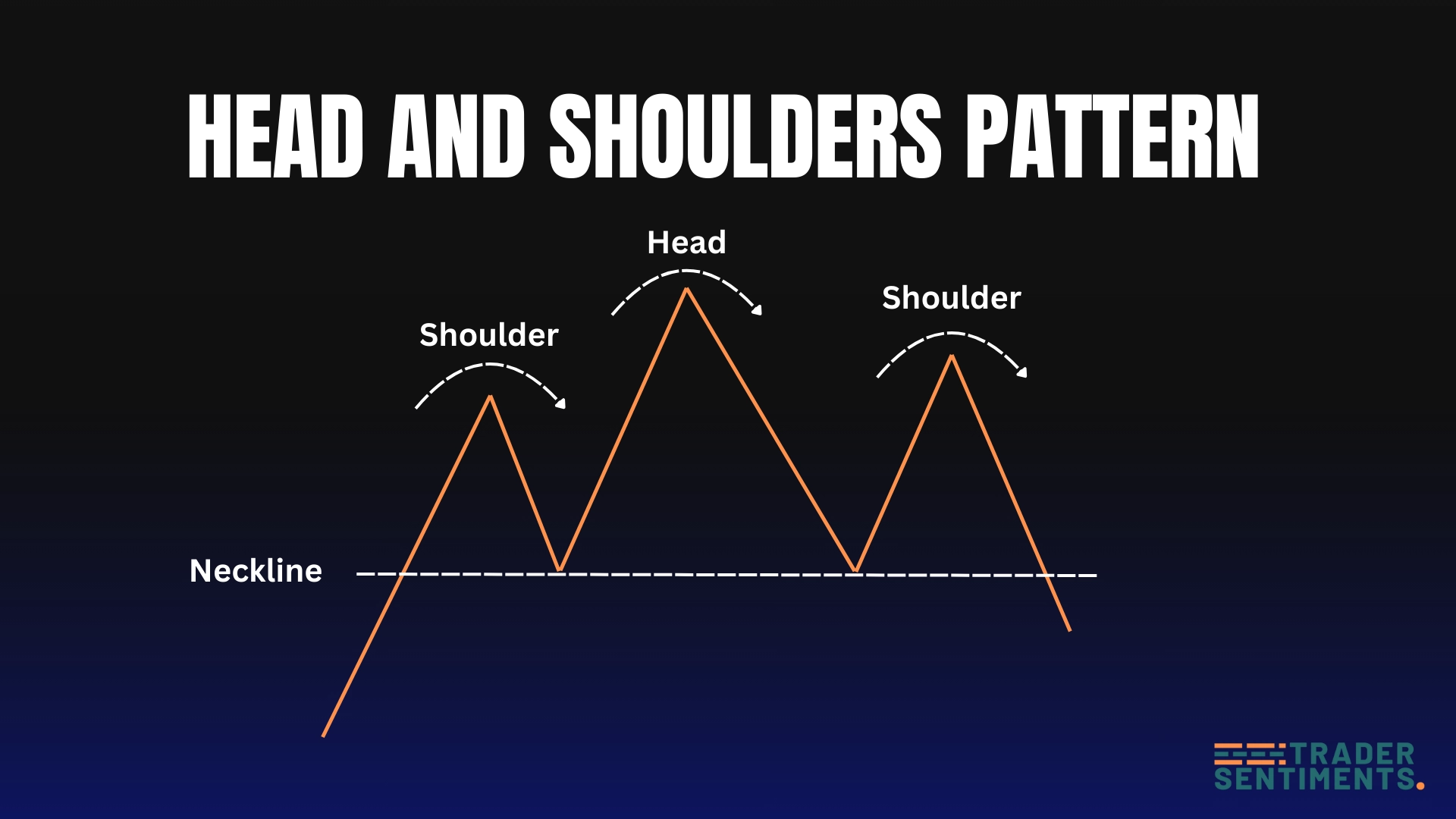

The head and shoulders pattern is a bearish reversal formation that signals the end of an uptrend. It forms when price creates three peaks: a left shoulder, a higher central peak (the head), and a right shoulder at approximately the same height as the left shoulder. The pattern is complete when price breaks below the neckline, which connects the lows between the peaks.

Pattern structure

- Left shoulder: Price rallies to a peak and pulls back.

- Head: Price rallies higher than the left shoulder, then pulls back again.

- Right shoulder: Price rallies but fails to reach the head's height, forming a lower peak similar to the left shoulder.

- Neckline: A support line drawn connecting the lows between the shoulders and head.

- Breakout: Pattern confirms when price breaks below the neckline with volume.

How to identify the pattern

To identify a valid head and shoulders pattern, look for these key characteristics:

The pattern must form after a sustained uptrend. It signals trend exhaustion and reversal.

Left shoulder and right shoulder should be roughly equal in height, with the head clearly higher.

The neckline can be horizontal, sloping up, or sloping down. It acts as support until broken.

Volume typically decreases as the pattern forms and increases on the neckline break.

Trading the pattern

Trading the head and shoulders pattern requires patience and discipline. Wait for confirmation before entering, and always use proper risk management.

Entry rules

- Conservative entry: Wait for a candle close below the neckline.

- Aggressive entry: Enter on the neckline retest after the break (not recommended for beginners).

- Volume confirmation: Look for increased volume on the neckline break.

- Timeframe: Higher timeframes (H4, D1) provide more reliable signals.

Stop-loss placement

Place stop-loss above the head. This gives the pattern more room but requires a larger risk.

Place stop-loss above the right shoulder. Tighter stop but higher risk of being stopped out.

Profit targets

Calculate your profit target by measuring the vertical distance from the head to the neckline. Project this distance downward from the neckline breakout point. This gives you a minimum target. Many traders also use support levels or Fibonacci extensions for additional targets.

- Measure distance from head peak to neckline = 200 pips

- Neckline breaks at 1.1000

- Minimum target = 1.1000 - 200 pips = 1.0800

Common mistakes to avoid

Wait for confirmation. Many patterns fail before the neckline breaks.

Low volume on the break suggests weak conviction and higher failure risk.

Patterns on M5/M15 have lower reliability. Stick to H4 and above for better accuracy.

Always use a stop-loss. Patterns can fail, and risk management is essential.