The double top is one of the most recognizable bearish reversal patterns in technical analysis, formed by two consecutive price peaks at approximately the same resistance level. It signals that buyers have twice failed to push price above a key resistance zone, a pattern that often precedes a significant and sustained decline. This guide covers the complete structure, psychology, entry techniques, confirmation signals, and risk management rules for trading the double top effectively.

What is a double top pattern?

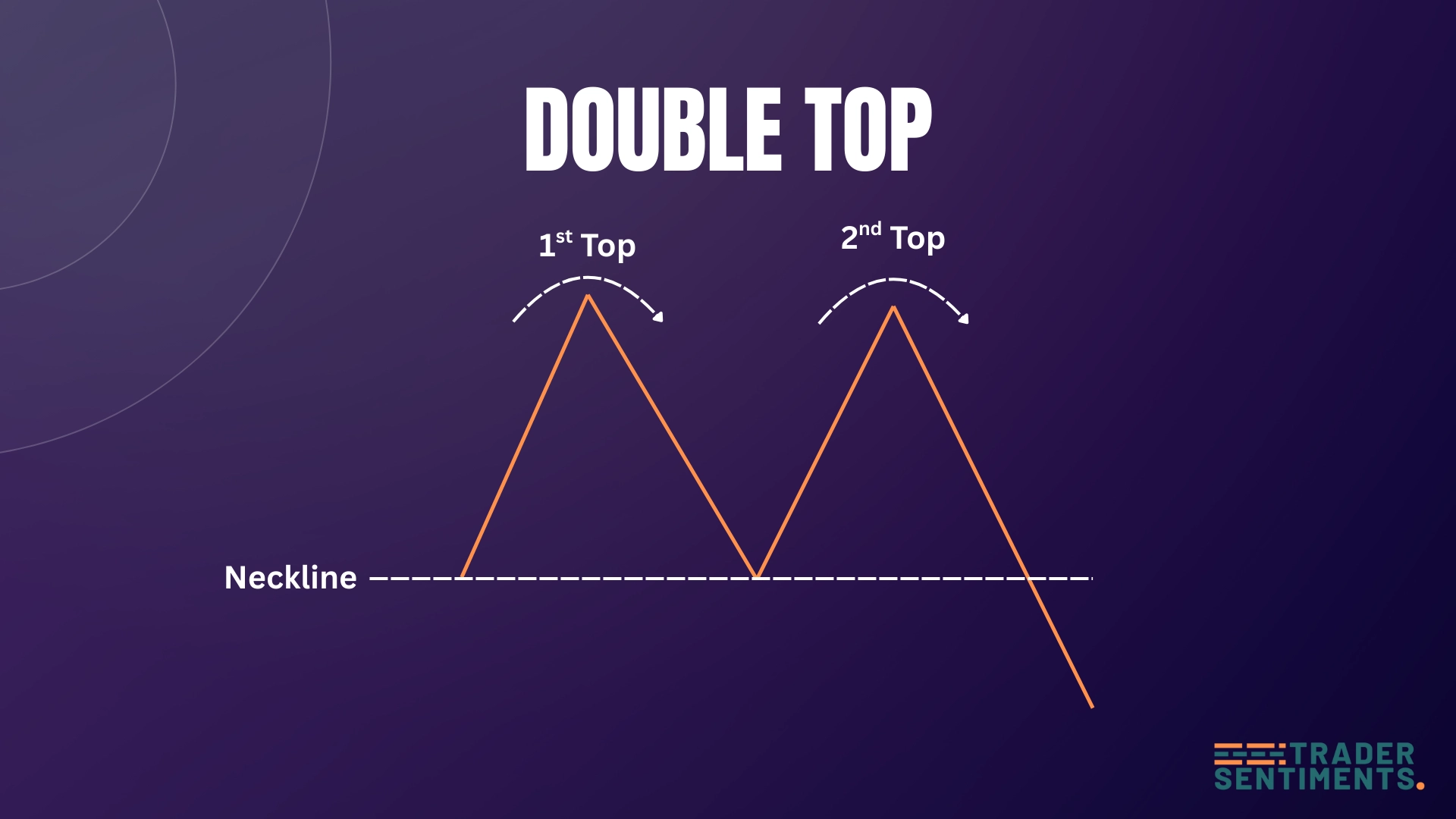

The double top pattern is a bearish reversal formation that signals the end of an uptrend. It forms when price reaches a resistance level twice, fails to break through, and then reverses. The pattern resembles the letter "M" and is complete when price breaks below the support level between the two peaks.

Pattern structure

- First peak: Price rallies to a resistance level and pulls back.

- Trough: Price retraces to a support level (the neckline).

- Second peak: Price rallies again to approximately the same resistance level as the first peak, then fails to break through.

- Neckline: A support line drawn at the trough between the two peaks.

- Breakout: Pattern confirms when price breaks below the neckline with volume.

How to identify the pattern

To identify a valid double top pattern, look for these key characteristics:

The pattern must form after a sustained uptrend. It signals trend exhaustion and potential reversal.

The two peaks should be at approximately the same price level. Small variations are acceptable, but they should be close.

There should be a noticeable trough between the two peaks. The pattern is stronger when the separation is clear.

Volume typically decreases on the second peak and increases on the neckline break, confirming selling pressure.

Trading the pattern

Trading the double top pattern requires patience and confirmation. Wait for the neckline break before entering, and always use proper risk management.

Entry rules

- Conservative entry: Wait for a candle close below the neckline (support level).

- Aggressive entry: Enter on the neckline retest after the break (higher risk).

- Volume confirmation: Look for increased volume on the neckline break.

- Timeframe: Higher timeframes (H4, D1) provide more reliable signals.

Stop-loss placement

Place stop-loss above the second peak. This gives the pattern more room and accounts for false breakouts.

Place stop-loss slightly above both peaks. Tighter stop but higher risk of being stopped out on volatility.

Profit targets

Calculate your profit target by measuring the vertical distance from the peaks to the neckline. Project this distance downward from the neckline breakout point. This gives you a minimum target.

- Measure distance from peaks to neckline = 150 pips

- Neckline breaks at 1.2000

- Minimum target = 1.2000 - 150 pips = 1.1850

Common mistakes to avoid

Wait for neckline confirmation. Price can break to new highs after forming what looks like a second peak.

If the second peak is significantly higher or lower than the first, the pattern is less reliable.

Low volume on the breakdown suggests weak selling pressure and higher failure risk.

Always use a stop-loss above the peaks. Patterns can fail, and risk management is essential.