The cup and handle is a classical bullish continuation pattern first described by William O'Neil in his landmark book on growth stock investing. It forms a rounded U-shaped base (the cup) followed by a brief, smaller consolidation (the handle) before price breaks out to new highs. The pattern is widely used by both equity and Forex traders for its clear structure, well-defined entry trigger, and historically strong post-breakout performance. This guide covers the pattern structure, psychology, entry rules, risk management, and confirmation signals.

What is a Cup and Handle?

The Cup and Handle is a bullish continuation pattern that resembles a tea cup. The "cup" is a U-shaped recovery, and the "handle" is a short-term consolidation or pullback. It indicates that the market is taking a breather before resuming the trend.

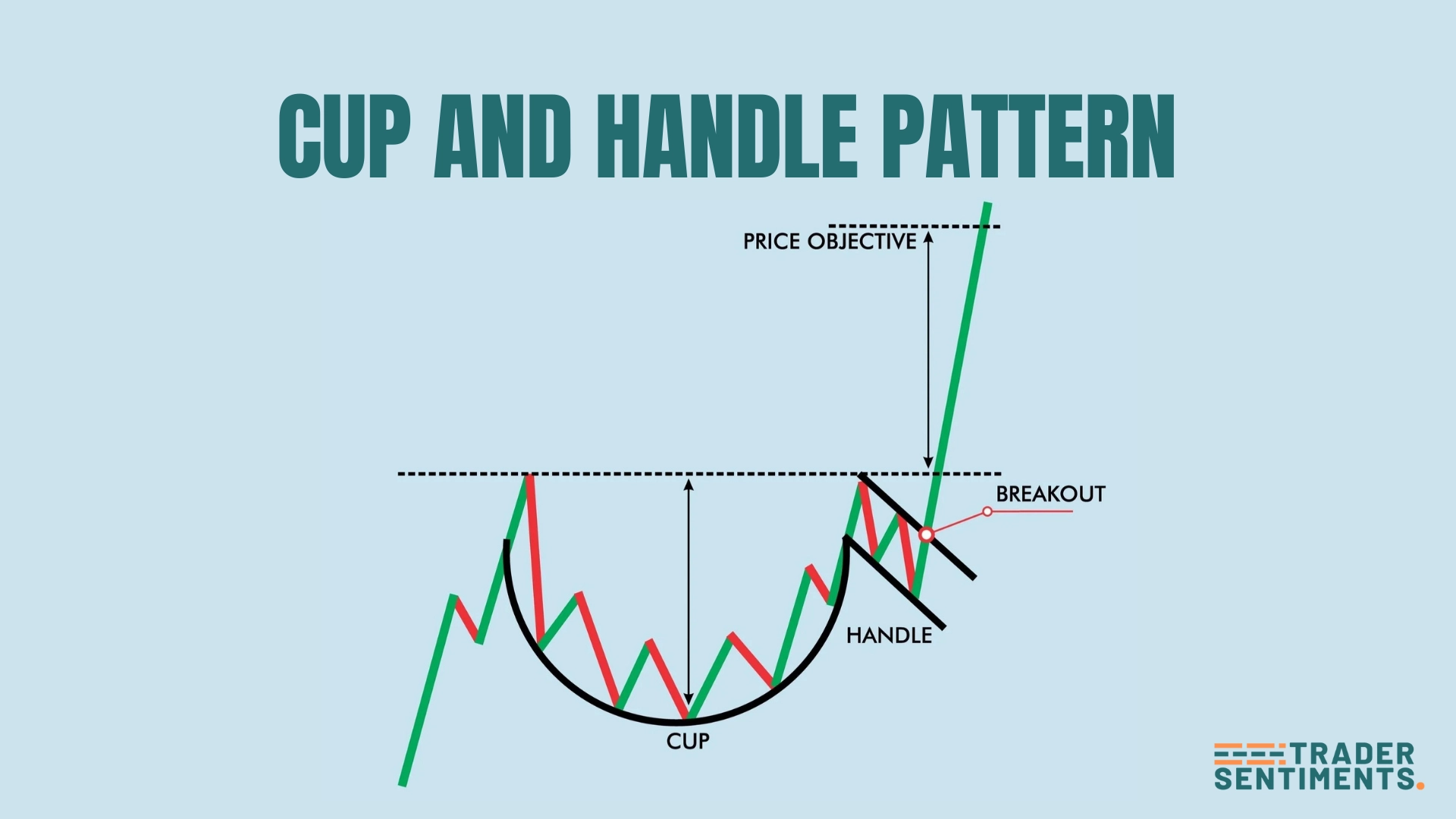

Pattern structure

- U-Shape: The cup should be rounded, not V-shaped.

- Handle: A downward drift or pennant on the right side.

- Handle depth: Should not retrace more than 1/3 of the cup's depth.

- Breakout: Price breaks above the rim/handle resistance.

How to identify

Must be preceded by an upward move.

The cup base should be smooth.

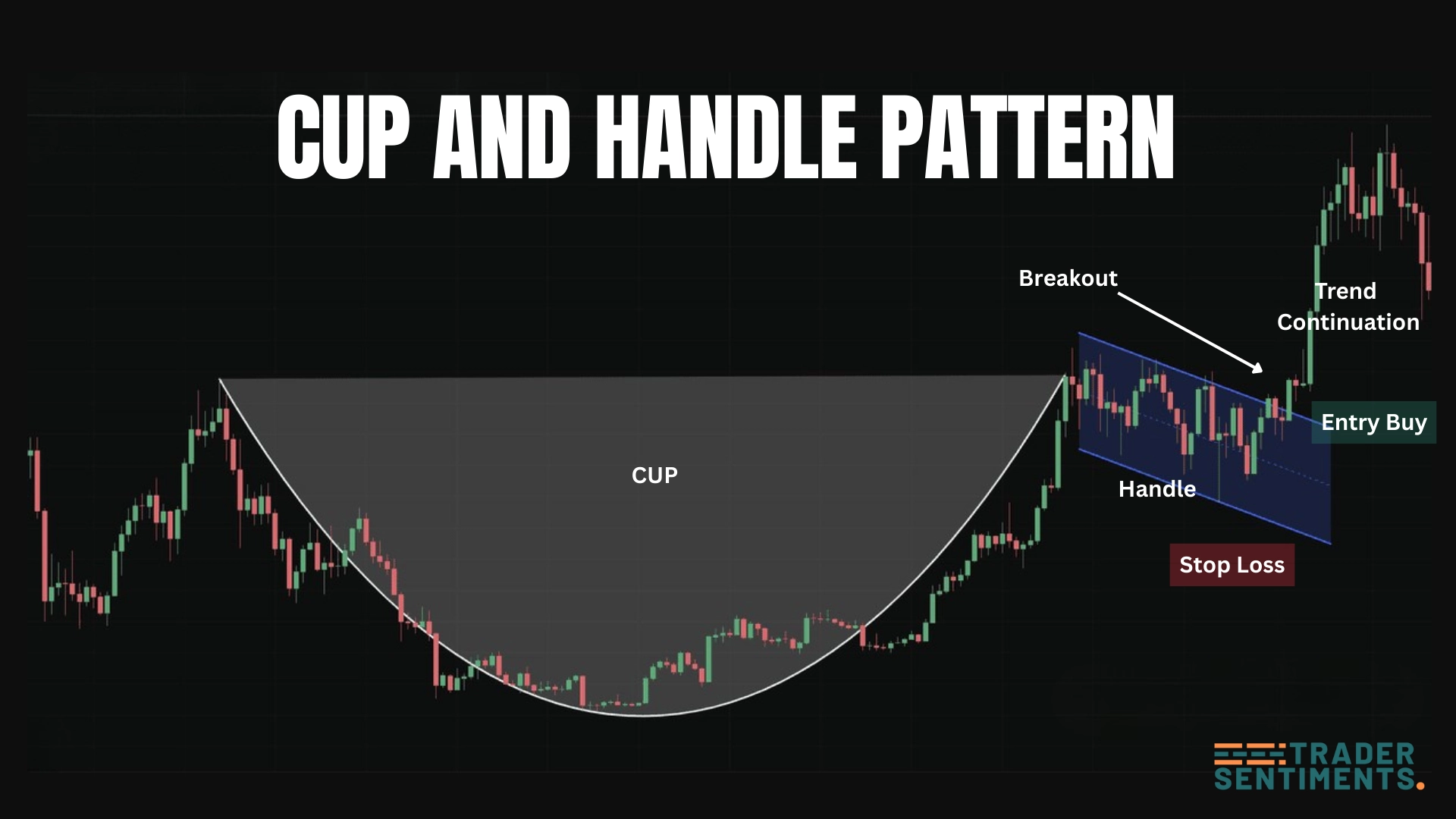

Trading the pattern

Entry rules

- Breakout: Buy when price breaks above the handle's upper trendline.

- Rim break: Buy when price breaks above the cup's rim (resistance).

Stop-loss placement

Below the bottom of the handle.

Below the handle trendline.

Profit targets

Measure depth from rim to bottom. Project upward from breakout.

Common mistakes

V-shaped recoveries are not cups; they are too sharp.

If the handle drops too low, the pattern may fail.