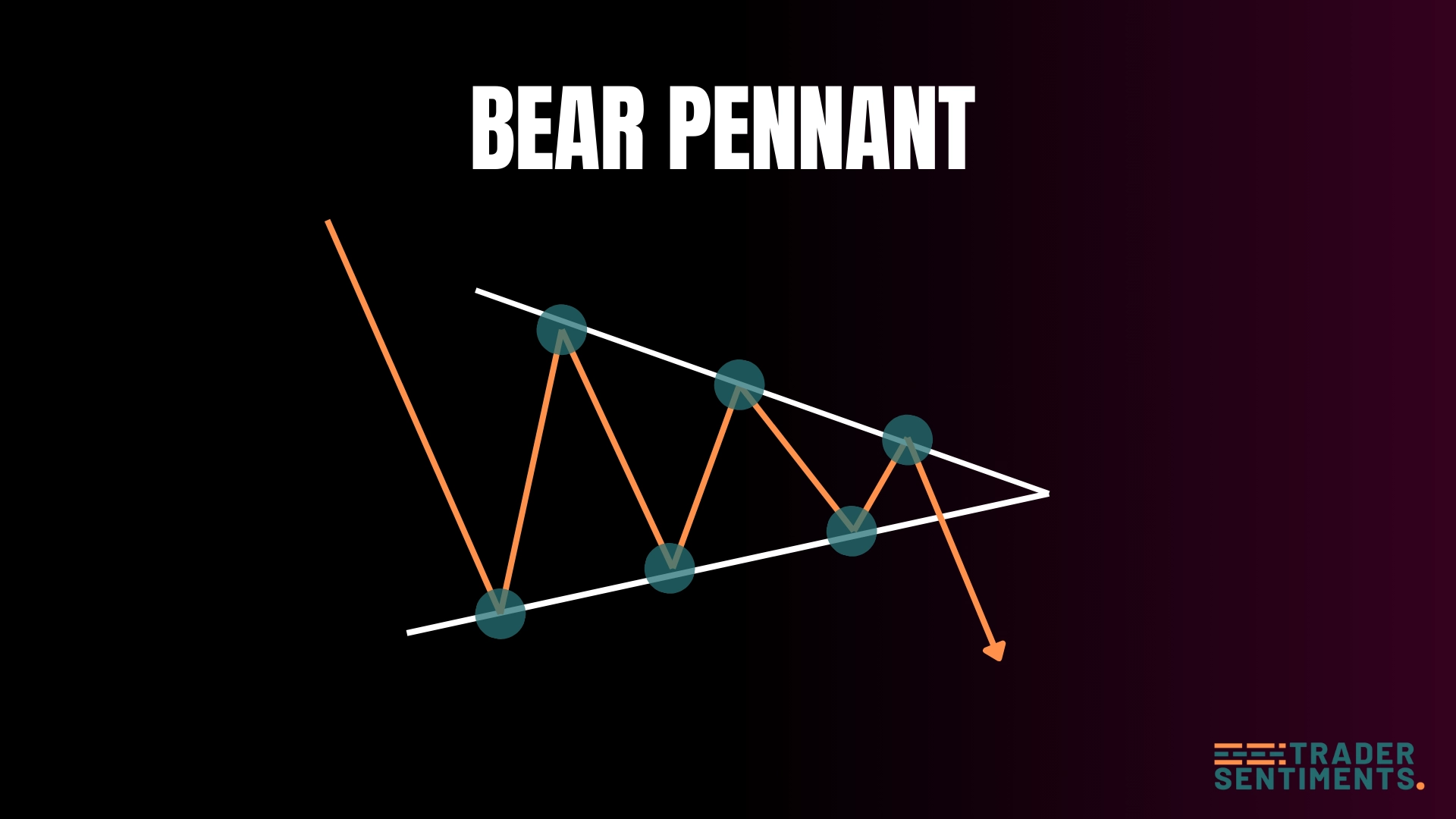

The bear pennant is a bearish continuation pattern that mirrors the bull pennant structure. After a sharp downward price move (the flagpole), price consolidates in a tight symmetrical triangle (the pennant) before breaking lower and continuing the original decline. Bear pennants signal a brief pause in a powerful downtrend and are valued for their clearly defined entry points and high-probability continuation when formed in strong downtrending markets. This guide covers the full structure, psychology, entry rules, and risk management for trading the bear pennant.

What is a bear pennant?

The bear pennant is a bearish continuation pattern with a strong downward move (flagpole) followed by a brief consolidation forming a small symmetrical triangle (pennant). The converging trendlines create a pennant shape before price breaks down.

Pattern structure

- Flagpole: Strong downward move on high volume.

- Pennant: Small triangle with converging trendlines.

- Volume: Decreases during pennant formation.

- Breakdown: Price breaks below lower trendline with volume.

- Continuation: Downtrend resumes.

How to identify

Must form during clear downtrend with strong flagpole.

Pennant should be brief.

Trendlines converge to form small triangle.

High on flagpole, low during pennant, high on breakdown.

Trading the pattern

Entry rules

- Conservative: Wait for candle close below pennant.

- Aggressive: Enter on breakdown retest.

- Volume: Confirm with increased volume.

- Timeframe: H4/D1 most reliable.

Stop-loss placement

Above pennant's highest point.

Above pennant's upper trendline.

Profit targets

Measure flagpole height, project downward from breakdown.

- Flagpole = 200 pips

- Breakdown at 1.1000

- Target = 1.0800

Common mistakes

Wait for confirmation.

Pennants should be brief.

Always protect capital.