The ascending triangle is a widely recognized bullish continuation pattern, and sometimes a reversal, defined by a flat upper resistance line and a rising lower trendline. Each touch of the flat resistance absorbs more supply, while rising lows show buyers growing increasingly aggressive. When resistance finally breaks, the result is often a sharp, high-momentum move. This guide covers everything traders need to know about identifying, trading, and managing risk on the ascending triangle.

What is an ascending triangle?

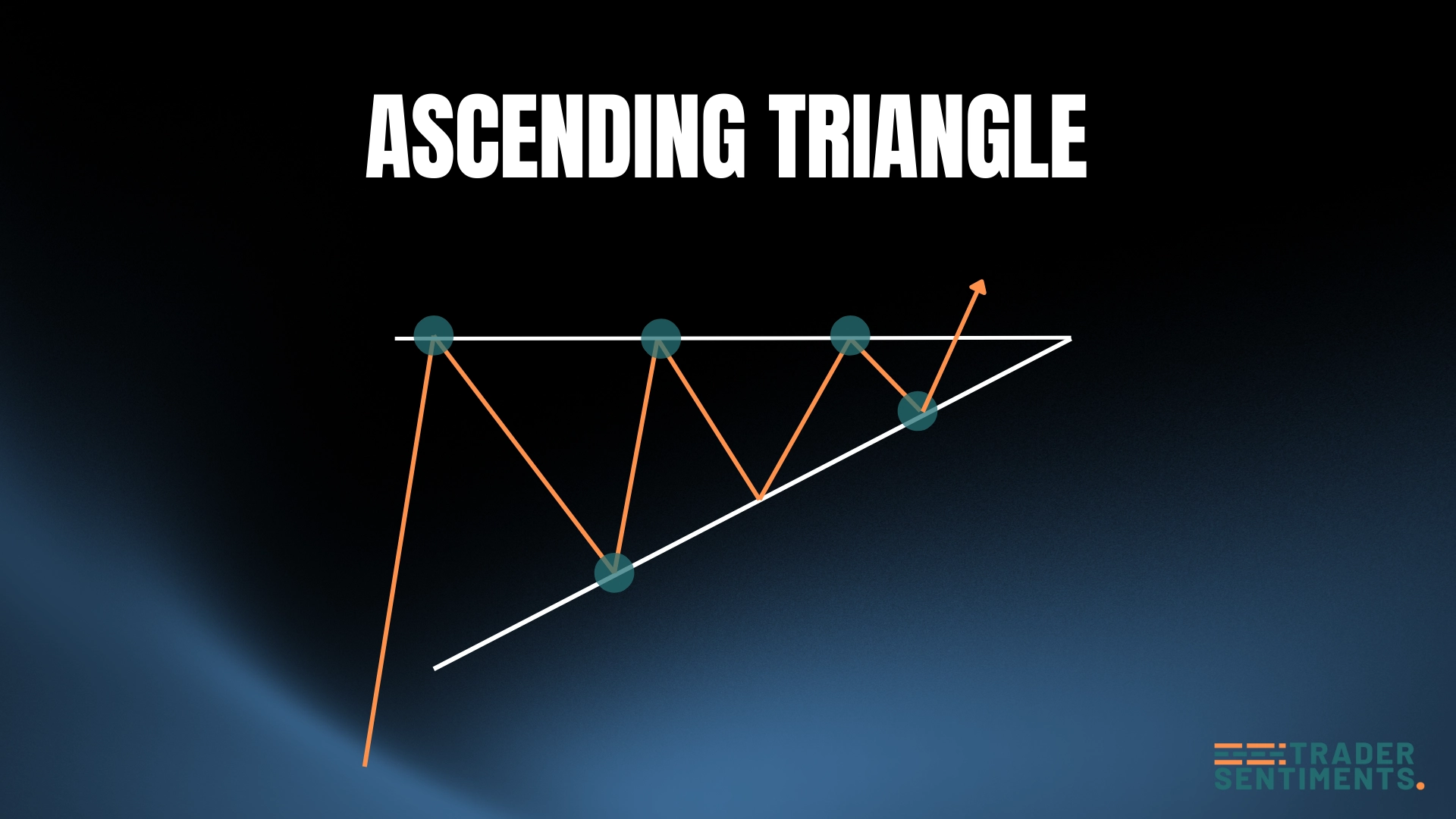

The ascending triangle is a bullish continuation pattern that forms when price consolidates between a flat horizontal resistance and a rising support line. Buyers become increasingly aggressive, pushing lows higher while resistance holds temporarily before breaking out upward.

Pattern structure

- Flat resistance: A horizontal line connecting at least two highs at the same level.

- Rising support: An upward-sloping line connecting higher lows.

- Consolidation: Price bounces between these lines, forming the triangle.

- Breakout: Price breaks above resistance with increased volume.

- Continuation: Uptrend resumes after breakout.

How to identify the pattern

Pattern should form during an uptrend as a continuation signal.

Resistance and support lines need at least 2 touches each to be valid.

Each low should be higher than the previous, showing buying pressure.

Volume decreases during consolidation, increases on breakout.

Trading the pattern

Entry rules

- Conservative: Wait for candle close above resistance.

- Aggressive: Enter on breakout retest.

- Volume: Confirm with increased volume on breakout.

- Timeframe: H4 and D1 are most reliable.

Stop-loss placement

Below the most recent higher low.

Below the ascending support line.

Profit targets

Measure triangle height at widest point, project upward from breakout.

- Triangle height = 150 pips

- Breakout at 1.1000

- Target = 1.1150

Common mistakes

Wait for confirmation.

Low volume breakouts often fail.

Always protect your capital.