Position trading is a long-term approach focused on capturing major market trends over weeks, months, or even years. This guide explains how position traders analyze markets, manage risk, and hold trades with discipline.

If you prefer a slower pace, fewer trades, and decisions based on bigger market structure, position trading is one of the most practical styles to learn. It’s not about catching every small move—it’s about aligning with the dominant trend and staying in the trade long enough for the “big move” to play out.

Because the holding period is longer, position trading usually requires stricter planning: wider stops, smaller position sizes, and a clear understanding of macro drivers and sentiment. The upside is you don’t need to sit in front of charts all day.

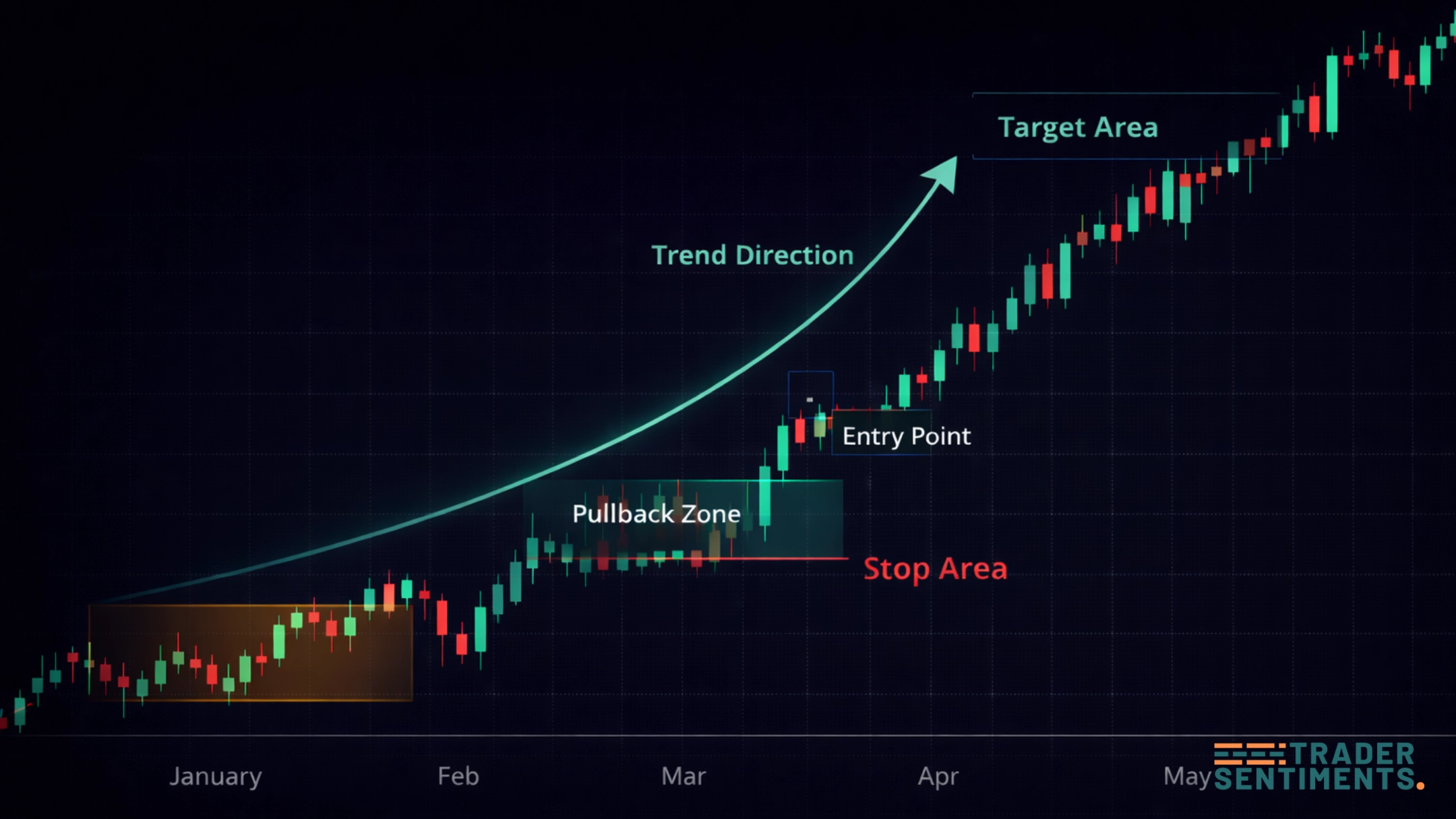

Example: higher-timeframe trend with pullback entry (replace with your own chart).

Position trading explained

Position trading focuses on higher timeframes such as Daily (D1) and Weekly (W1). Instead of reacting to small intraday fluctuations, position traders attempt to capture large directional moves that come from macro conditions (interest rates, inflation trends, central bank policy, risk-on/risk-off sentiment, and long-term supply/demand).

Position traders often enter after a pullback or consolidation within the trend, then hold through multiple sessions—sometimes through several market cycles. This makes entries and risk planning more important than speed.

- Define trend direction on W1 and D1 (structure + key levels).

- Validate macro bias (rates, inflation, central bank tone, broad risk sentiment).

- Wait for pullback into support/resistance or a clean consolidation.

- Enter with a clear invalidation level and a conservative size.

- Manage the position weekly, not every minute.

Key characteristics

Position trading is defined by patience and higher-level decision making. You will generally place fewer trades, but each trade has a bigger thesis behind it.

- Low frequency: fewer setups, higher quality filters.

- Higher timeframes: W1/D1 structure drives decisions, not M15 noise.

- Wider stops: stops are placed beyond long-term invalidation zones.

- Smaller size: position size is reduced so the wider stop still fits your risk plan.

- Longer holding: you accept pullbacks and volatility within the big move.

- Busy traders (less screen time).

- Macro + trend-based traders.

- Traders who prefer fewer decisions.

- Traders who need fast feedback loops.

- People who panic during drawdowns.

- Over-leveraged accounts.

Market analysis for position trading

Position traders commonly combine macro fundamentals with higher-timeframe structure. The goal is to avoid trading against the “big driver” of the market. For FX, rate differentials and central bank guidance can dominate for months. For gold, real yields and USD trend often matter. For indices, earnings cycles and liquidity conditions can set the tone.

On the chart, many position traders keep it simple: identify weekly support/resistance, trend structure (higher highs/higher lows), and major breakout zones. Then wait for price to return to a good area, rather than chasing.

- Is the weekly market structure bullish, bearish, or ranging?

- Where are the major weekly supply/demand zones?

- Is the daily trend aligned with the weekly?

- Is price in a premium/discount area relative to the latest leg?

- What macro theme could support the move for weeks?

If your macro view and structure are aligned, entries become easier: you can wait for pullbacks, break-and-retest, or a clean shift in daily momentum after a correction.

Risk management approach

Risk management is the main “edge” in position trading. Because stops are wider and holds are longer, you must size positions correctly. Many position traders risk a small portion per trade (for example, 0.25% to 1%) and accept that trades can take time to work.

- Overnight gaps and surprise news.

- Swap/rollover costs over long holds.

- Large pullbacks inside trends.

- Correlation risk (many positions tied to USD).

- Keep leverage conservative.

- Use structure-based invalidation, not emotional stops.

- Don’t stack the same macro bet across many pairs.

- Review weekly, not every candle.

A strong position trading plan is designed to survive volatility. If your strategy requires you to “never be in drawdown,” it’s not realistic. Instead, plan how much drawdown you can tolerate and size positions so your account stays stable while the idea plays out.

Building a position trading strategy

A position trading strategy should be written like a system—clear conditions, clear risk, and clear management. The goal is to reduce decision fatigue and avoid overreacting to short-term fluctuations.

- Define market universe: pick a small set of liquid instruments (major FX pairs, gold, indices).

- Trend filter: decide how you define trend on W1/D1 (structure, MA slope, or breakout behavior).

- Entry model: pullback to weekly level, break-and-retest, or daily momentum shift after correction.

- Invalidation: place stops where the thesis is wrong (beyond weekly structure).

- Targets/management: scale out at key weekly levels, trail behind structure, or hold until trend breaks.

- Bias: Weekly trend bullish.

- Entry: Daily pullback into weekly demand + daily reclaim.

- Stop: Below weekly demand invalidation.

- Take profit: Next weekly resistance (partial) + trail remainder.

- Risk: 0.5% of equity per position.

Keep the system consistent for at least a few months before changing rules. Position trading is slow by nature—your strategy needs enough time and enough trades to prove whether it works.